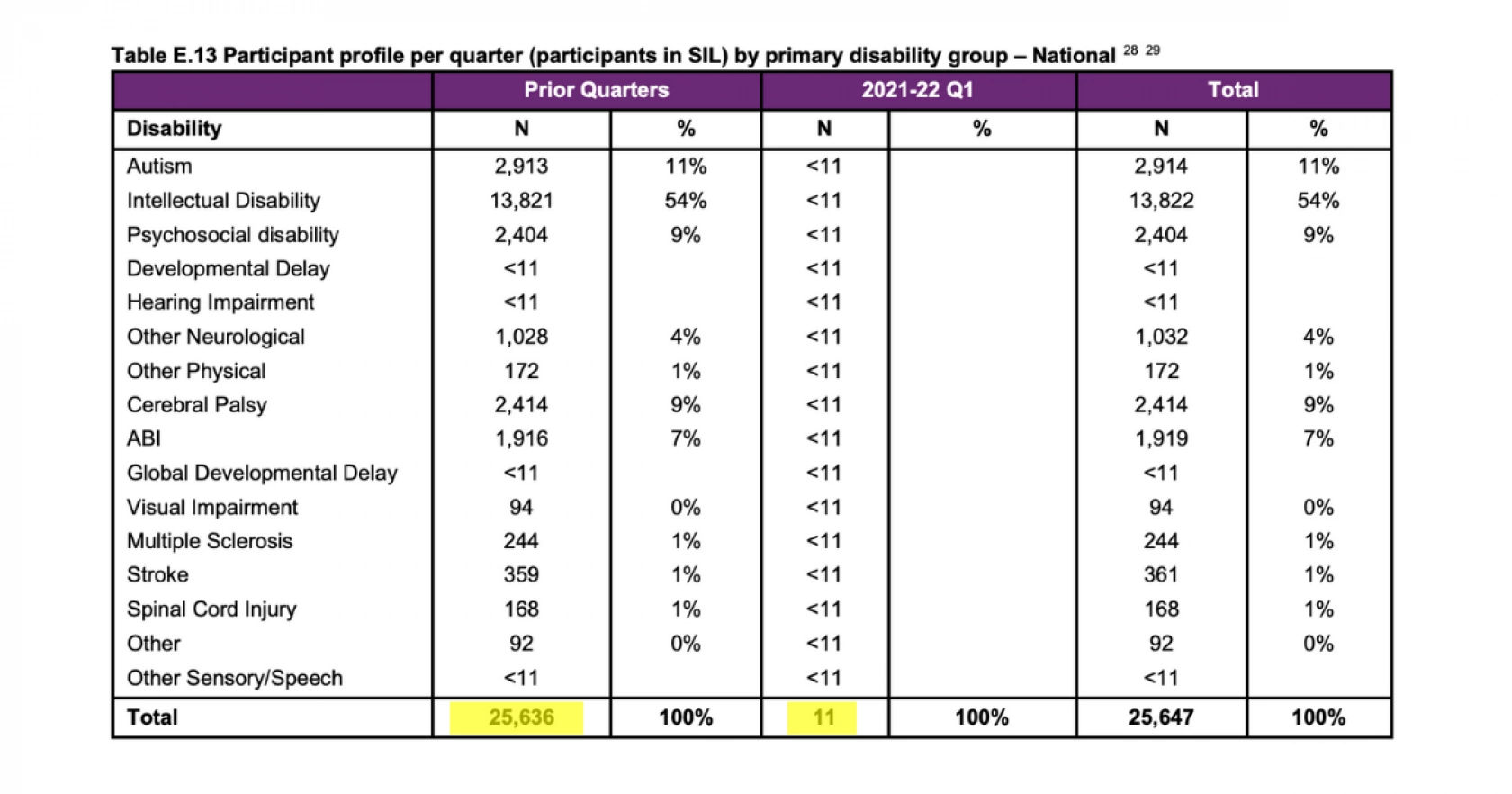

When I first saw this table I started to worry:

Does this table suggest that in 2021-2022 Q1, only an additional 11 Participants had SIL in their plans? You’re likely thinking the same thing I did - how is this possible? And our readers would know that it isn’t - we have previously reported that 327 customers entered SIL in the same period (and that was also from the NDIA).

I don’t know how many people are reading the footnotes, but that doesn’t matter because we’ll keep reading them for you.

This footnote provides a helpful insight into the market dynamics of SIL. In effect, we now know that SIL increased by 327 people, but only 11 had SIL registered in their first plan.

This marks a significant change from the scheme’s inception. Many of you will have likely assisted someone who inquired about SIL but hadn’t yet engaged with the agency. I personally set up distinct onboarding workflows for these groups. As a result, the likelihood of this transaction is now extremely low.

This information gives us some insight into where we are likely to encounter SIL enquiries in terms of their NDIS journey. Your SIL customers are likely to have a far greater knowledge of the NDIS and a much better understanding of market dynamics and their bargaining power.

This also means that nearly all SIL customers will have an experience with a provider under their belt, and there is a good chance that this provider, in fact, provides SIL. While Support Coordinators are renowned for their remarkable impartiality in the face of all kinds of perverse incentives, the fact remains that if this person isn’t in your service, someone may have already had a conversation with them about SIL.

Many service providers we have worked with run community participation at a considerable loss. CFO’s should consider community participation and COS as part of the customer lifecycle. If your service is excellent, this positive impression is likely to weigh into the SIL decision.

It also confirms something that many of our readers suspect or know. Referral business will likely drive SIL growth, which fundamentally rearranges the marketing equation. Of course, many providers have developed excellent web presences (we love the Scope service finder), but this is likely not driving new business. Instead, the purchasing decision is likely being made or assisted by someone who understands the industry and has at least some tacit knowledge of service quality and reputation.

Market sizing for differentiation

The other thing this table demonstrates is that there is considerable scope for specialised offers. The psychosocial and Autism markets combined are worth nearly $2billion annually (assuming their average package is consistent with the broader scheme). Our view is that it is becoming increasingly viable to develop specialised products for these markets, even their submarkets. If you are interested in understanding the size of your SIL program in relation to the total market size, then why not try out our free growth calculator.

Intellectual disability

As you likely know, intellectual disabilities dominate the SIL space at 54% of the cohort. Indeed, much of the SIL experience is designed around this cohort or carried forward from the ADHC days. Unfortunately, Empathia Group has seen very little innovation around this cohort, which has led to views that SIL for ID is a commodity, interchangeable and fungible. We disagree with this view, and we want to outline a fundamental tension between large and small providers that could be an unrecoverable disadvantage.

We work with a provider whose managing director has committed to individually and in person, reviewing every customer’s goals and soliciting feedback fortnightly. In the Royal Commission, we saw time and time again that larger providers are so complex that it is more or less impossible for them to replicate this commitment. We believe that this is precisely the personal relationship and accountability that sets certain providers apart. It is impossible to deliver this at a certain scale from our perspective. We want to get your views about whether or not this would be valuable to new SIL customers entering the market. We would also appreciate your opinions as to whether this is in any way deployable at larger providers. If you like numbers - would you be prepared to tell us how much of the purchasing decision this product “feature” is likely to represent?

We spend a lot of time thinking about and deploying competitive advantages in the SIL and ILO space. If you would like to see how you stack up, consider using our SIL growth calculator to evaluate your performance, or try our free SIL assessment to evaluate how your marketing, finance and HR functions drive SIL growth.

This is the end of our SIL market series. We’ll be doing deep dives into differentiation, competitive advantage and employee retention. So you can expect data and no fluff.

Original written at Empathia Group.